Compliances in Banking Financial & Services Industry

Introduction

The Banking, Financial Services, and Insurance (BFSI) sector is valued at a staggering Rs 81 trillion and will likely become the third-largest in the world by 2025. The BFSI sector of India has historically been among the most stable systems globally and has strived consistently to ensure the financial inclusion of the country’s underprivileged population.

The Indian BFSI sector can broadly be classified into banks and NBFIs (non-banking financial institutions). While banks can accept demand deposits and issue cheques, NBFIs/NBFCs cannot do either. The BFSI sector represents a significant portion of the massive Indian economy and includes financial services of banking, insurance, NBFCs, asset management, cooperative banks, pension funds, mutual funds, broking firms, etc.

Investment banks are a crucial part of the BFSI sector, facilitating business operations like equity offerings, expenditure financing, and initial public offerings. Investment banks may also help organizations manage mergers, acquisitions, and additional corporate restructurings apart from facilitating trading exchanges and offering brokerage services to investors.

Primary dealers (PDs) are another type of financial entity registered with the RBI. They have the right to sell and buy government securities to buyers of the secondary market. You also have Credit Information Companies (CICs), which are non-profit organizations that identify and collect information on enterprises and customers. CICs advise banks on the creditworthiness of customers based on their history of payments and help them assess the risk involved in lending.

Top 5 Indian financial regulatory bodies governing the BFSI Sector

- The Securities and Exchange Board of India (SEBI), which regulates the Indian capital markets

- The Reserve Bank of India (RBI), which formulates India’s monetary policy

- The Insurance Regulatory Development Authority of India (IRDAI) monitors the insurance sector

- The Pension Funds Regulatory and Development Authority (PFRDA), which regulates pensions

- The Ministry of Corporate Affairs (MCA) oversees the corporate sector.

The Indian banking system comprises 12 public sector banks, 22 private sector banks, 43 regional rural banks, 12 small banking finance banks, and 45 foreign banks as of August 2022. India is one of the world’s biggest and fastest-growing FinTech markets, where commercial banks account for over 64% of the total assets held by India’s financial system.

Critical Legal Issues in the BFSI Industry

The Indian BFSI segment undergoes recurrent regulatory changes and reforms and has encountered multiple regulatory requirements recently. This includes protocols related to the adoption of automation, digital security, and user privacy.

Gururaj Rao, the CIO of Mahindra Finance, recently said that the after-effects of demonetization and GST compelled banking and NBFCs to comply with various regulatory mandates. However, there are a few recurrent problems that have affected the financial stability and profitability of this sector, which are mentioned below:

- Asset Quality: The economic slowdown over the last few years has led to a rise in bad loans or non-performing assets in India. This leads to restructured assets, which pressure the bank’s profitability. IMF reports that 36.9% of India’s total debt is at risk.

- Inadequate Capital: To ensure that they are protected from bad loans, banks often set aside some money, which is known as a provision. As provisions cannot be used for purposes like lending, banks have lower capital for their operations. As a result, they have to borrow or use depositors’ money for lending, which is costlier and riskier.

- Balance Sheet Management: Many banks have tried to delay provisions to post higher profits in the short run. This reduces the ability of a bank to withstand financial pressures.

- Unhedged Forex exposure: Fluctuations in the forex market can significantly stress Indian companies that have borrowed heavily from abroad. This may affect their ability to pay their debt back to Indian banks.

- Security & Privacy concerns: Recent studies reveal that the technologies used in cloud computing for e-banking services in India are highly unsafe. This makes customers and businesses vulnerable to online scams and banking frauds. Even after preventive measures like KYC and biometric finger verification, such concerns loom at large.

- Legal Issues: The Indian IT Act, 2000, and the IPC Act, 1860 are two of the major regulations that combat cybercrimes in India. The other laws that help prevent financial crimes are:

- RBI Act, 1934

- Forex Management Act, 1999

- Banking regulation Act, 1949

- Indian Evidence & Contract Act, 1872

- Negotiable Instruments Act, 1881

- SARFAESI Act, 2002

Despite the above, there is still much lacking in the legal structure and system. Additionally, the lack of a proper enforcement structure and trained personnel which allows cybercrimes to proliferate rapidly.

BFSI Regulations in India

The BFSI sector in India is primarily governed by the Banking Regulation Act, 1949, and RBI Act, 1934 allows the RBI to issue regulations and directions on a wide assortment of issues. Additionally, the Foreign Exchange Management Act of 1999 governs international transactions and related activities.

Along with SEBI and IRDAI, the RBI also liaises closely with the Insolvency and Bankruptcy Board of India (IBBI) to regulate banking activities. As a result, foreign banks will now be permitted to have subsidiaries or branches, but not both.

Registrations & Licenses

A business entity that wants to carry out banking businesses in India must obtain an RBI license. Licensed banking organizations can also conduct ancillary industries like borrowing, trade finance, lending, indemnity, financial leasing, etc.

Any business proposing to deal in foreign exchange must also obtain a separate license for an authorized dealership from RBI. The permit is issued under the Foreign Exchange Management Act, and authorized dealers are provided with many powers to facilitate and monitor foreign exchange and international transactions, including remittances to and from India.

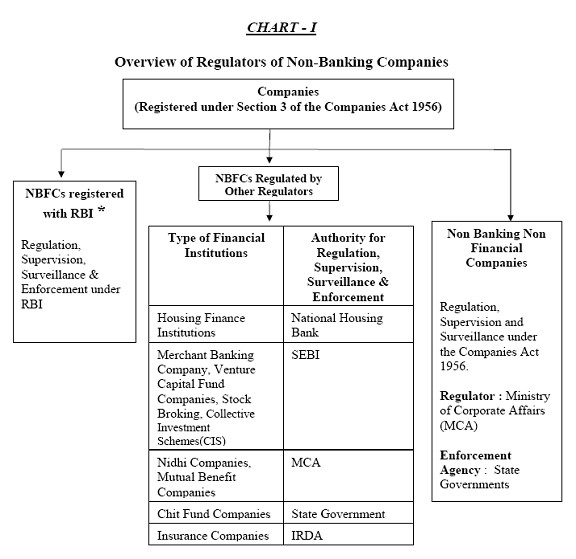

The following image depicts the regulators for NBFCs in the country today:

Prior to the commencement of an NBFC’s business after registration, here are a few compliances that need to strictly followed for further operations:

- Central KYC

- Registration with 4 credit rating agencies – CIBIL, Experian, ICRA & Equifax

- CERSAI Registration

- FIU-IND Registration

- Adoption of Fair Practice Code

- National e-Governance Registration

- Adoption of IT and Anti Money Laundering Policies

- Submission of Financial Information to Information Utilities

To register for a bank license, you must file an application to the RBI. Applicants must fall within the criteria prescribed by the “on-tap” licensing guidelines of the RBI, which were introduced on August 1, 2016. Indian incorporated entities seeking bank licenses must have a minimum paid-up voting equity (or net worth) of INR 5

billion.

Top Hospitality Industry compliances in India

Here are some of the key compliances that are to be followed in the BFSI sector:

- Opening a New Place of Business: Under Banking (Regulation) Act, 1949 every Banking Company needs to file an application to the principal office of the Reserve Bank to obtain permission for opening of new places of business.

- Return on Ownership and Control (ROC): Under Banking (Regulation) Act, 1949 every Banking Company needs to file a return on Ownership and Control (ROC) with the RBI on a half yearly basis containing the details of ownership pattern of the bank and details of Executive/Whole Time Directors and Non-Executive Directors including details of such other companies in which any of such officials are interested along with nature of interests.

- Maintenance of Cash Reserve: Under Banking (Regulation) Act, 1949 every Banking Company needs to maintain by way of cash reserve with itself or by way of balance in a current account with the Reserve Bank, or by way of net balance in current accounts or other mentioned ways, a sum as

prescribed. Also, a monthly return regarding the same shall also be furnished. - Sending a list of Offices: Under Banking (Regulation) Act, 1949 every Banking Company needs to send a list relating to its offices in India to the principal office of the Reserve Bank in Form VII within a period of 1 month from the close of every quarter.

- Technology and Security Standards: Under the Payment and Settlement Systems Act, 2007 all banks which undertake mobile banking transactions must adhere to the guidelines of Technology and Security Standards as provided in Master Circular – Mobile Banking transactions in India.

- The Companies Act, 2013: All NBFC institutions in India must follow the below provisions laid down by the Registrar of Companies:

- Statutory Meetings Convene

- Financial Statements Filing under AOC-4

- Income Tax Returns Filings

- Filing of annual reports under MGT-7

- Auditor’s appointment under ADT-1

- Drawing up fiscal statements

- Book & Account maintenance

- Holding Regulatory ROC registers

Indian NBFCs also must adhere to the following annual compliances:

- DNBS- 02 Return (for non NSDI-NBFCs)

- DNBS-010 (for all NBFCs & ARCs)

Apart from the above, several acts related to statutory compliance, including the Trade Unions Act, 1923, the

Factories Act, 1948, and the Payment of Wages Act, 1936, govern the companies operating in India.

Recent NBFC Regulations

On October 11, 2022, the RBI issued a notification for multiple NBFCs in a group. Referring to the four-layered regulatory structure of NBFCs under a scale-based framework, the RBI ruled

that NBFCs that are a part of a common group or had been floated by a common set of promoters shall not be viewed on a standalone basis. The total assets of all NBFCs1 in Group 2 should be consolidated in accordance with the present policy on NBFC asset consolidation to establish the cut-off point for their classification in the Middle-layer.

On October 6, 2022, the Ministry of Commerce & Industry announced the Credit Guarantee Scheme for Startups (CGSS) to provide guarantees upto a specific limit against credit instruments extended by Member Institutions to finance eligible startups in India. This scheme would provide the much-anticipated collateral-free debt funding to startups.

On October 1, 2022, the RBI decided to re-issue Master Direction of NBFC – Systemically Important Non-deposit taking and Deposit-taking Company Directions, 2016. The purpose for the same was to enable the RBI to regulate the financial system to the country’s advantage and prevent any affairs of Systemically Important Non-deposit taking and Deposit-taking Companies from being conducted in a manner that is detrimental to investor/depositor interests, or prejudicial to the interest of such NBFCs.

Conclusion

When institutions do not follow legal guidelines, they are typically penalized by the government. Non-compliance puts a business at immense risk and hurts its employees and clientele, apart from ruining its social reputation. Additionally, licenses may be canceled or suspended if such offenses are repeated. This is why most modern firms go for compliance management solutions.

Read more about how RBI is Pushing for Compliance Management System